Farmers learn to cope with financial stress – Reprinted from Farm and Dairy, Salem, Ohio. Story and photo by Chris Kick, December 19, 2016.

Stress that doesn’t go away can cause physical issues and impair our ability to work, said a mental health professional who kicked off a daylong program about farm financial stress Dec. 16 at the Ohio Agricultural Research and Development Center in Wooster.

“A little bit of stress response, a little bit of agitation can be healthy and help us cope,” said Jim Foley, a counselor and suicide prevention expert with The Counseling Center of Wayne and Holmes Counties.

Changing the brain

When the stress becomes chronic, however, “then it changes our brain, it changes our body in ways that make us more prone to anxiety and depression.”

Farmers, in general, are feeling a lot of financial stress right now, after a couple years of low grain prices and low prices for livestock and milk. The financial concerns of farmers, and their worries over the future of their operation, prompted the Wayne County OSU Extension and its partners to put together the program to help farmers manage financial stress.

Take a break

Foley said each person’s situation is different, but one thing that can often help is to take a break, and evaluate the situation.

“If you push through your stress because you want to keep being able to work, you may get sick and be less able to work,” he said.

Another tip he offers is to “do one thing at a time,” and try not to worry about situations or people that you have no control over.

The biggest financial stressor for farmers right now is the low returns per investment. Whether it’s milk, livestock or cash grain crops, the prices are down significantly.

Year of losses

Dianne Shoemaker, Ohio State University Extension dairy field specialist, said income per cow this year, on average, are expected to be a loss of $300-$500/head. In 2015, returns averaged $36 per cow, and in 2014, returns were at a historical high of more than $1,200 per cow.

The fall in prices affects each farm differently, depending on management and how the farm operates. But the downward trend, in general, has cost all farms money.

“There are some people who aren’t feeling a whole lot of hurt right now, but there are also families that are experiencing a great deal of financial stress,” Shoemaker said.

What it all boils down to, Shoemaker said, is farmers need to ask themselves: “Are we making money, and are we making enough money?”

Do the math

She highlighted a variety of calculations that all dairy farms should be making, such as the “current ratio,” the “debt to asset ratio,” the “net farm income,” and the farm’s level of equity and working capital.

It’s OK to have debt, she explained, as long as it’s managed. Farmers who have 30 percent or less debt to assets are generally considered “strong,” she said. But 30-40 percent enters the “caution” phase, and anything greater than 40 percent debt is generally considered “vulnerable.”

Shoemaker said farmers also need to pay attention to personal costs and making sure they’re making enough money to cover things like retirement.

Foley said one thing that financially strapped farmers need to consider is the option of selling out. While that’s often a last resort, and one that no one likes to think about, Foley said it helps to at least explore all options.

When farmers look at the full array of options, Foley said it can help them see their situation differently — and even avoid selling out — if they find another solution.

Work with your lender

A group of ag lenders who spoke in the afternoon said they’d rather farmers contact them as soon as possible when facing financial stress. They said with open communication, they can evaluate the situation, and often help offer solutions to keep the farm in business.

“The last thing that we want to do is to see someone lose a farm, lose the operation or greatly impact how they’re able to do business,” said Lee Fitzsimmons, an ag lender with Wayne Savings Community Bank.

Fitzsimmons said the goal is to work with farmers, and help them find other sources of income, whether on or off the farm.

The lenders, which also included Tom Stocksdale, of Farmers National Bank, and Seth Wilkerson, of Farm Credit Mid-America, said they’re also seeing farmers work with financial coaches and financial advisers, to make better management decisions.

They said it’s important for farmers to keep good fiscal records, including a balance sheet, and to be able to demonstrate or discover a path toward success.

Think ahead

For farmers who are considering going out of business — whether for fiscal reasons or retirement — there are also a lot of important financial decisions.

Robert Moore, an attorney with Wright & Moore Law Co., said one of the biggest considerations is taxes.

He recommended farmers think about their farm’s end date long before quitting, and said it’s usually easier for tax purposes to quit at the end of the year.

Farmers also need to consider what they will legally and ethically do with their employees, and how they will part with all of their assets, including land, livestock, crops and equipment.

Moore said employees can be let go when the farmer decides to end the operation, but they must receive their last paycheck by the next pay period, or within 15 days. He said it may be more ethical to factor in a severance pay, so the workers aren’t being dealt a surprise and so the farmer has dependable labor up until the end.

He recommended working with a tax adviser and other professionals as needed.

Last options

Moore said it may also be appropriate — and even beneficial — to file bankruptcy.

Although bankruptcy is generally considered a last resort, depending on the type filed for, the farmer may be able to stay in business while restructuring and paying off debt.

Other types of bankruptcy are more severe, and could involve liquidation and payment of creditors from the sale of assets.

Whatever happens, Foley said there’s always a next step in a farmer’s life. It may be with or without the farm, but it’s important to know there are still options for healthy living.

Visit Farm and Dairy to read this and other stories here.

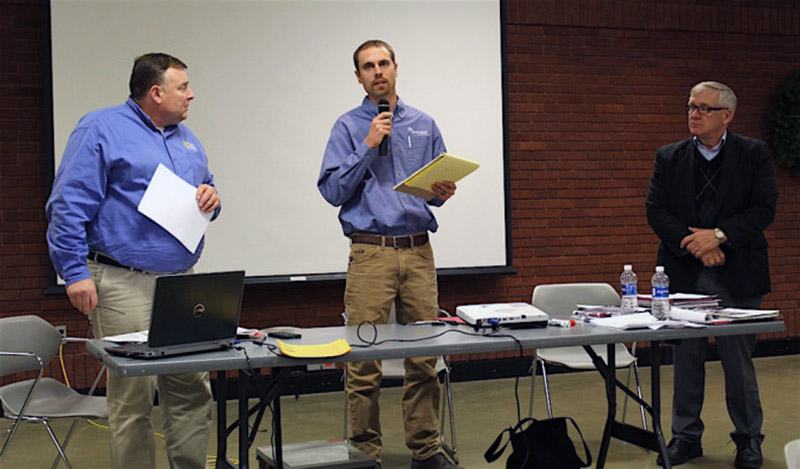

Lee Fitzsimmons (left), ag lender with Wayne Savings Community Bank, Seth Wilkerson, of Farm Credit Mid-America, and Tom Stocksdale, of Farmers National Bank, talked about some of the financial issues farmers are facing and the opportunity to get help, during a financial stress workshop Dec. 16 at the OARDC in Wooster.

Founded in 1899, Wayne Savings Community Bank is based in Wooster and has 11 branch offices serving seven communities in northeastern Ohio. The bank offers a full range of products and services for consumer, small business, and commercial customers. For more information, please visit waynesavings.com. Member of the FDIC and Equal Housing Lender.